Real estate investors need comprehensive insurance covering physical damage, liability claims, and rebuilding costs from natural disasters or structural failures. Coverage limits, deductibles, and exclusions should be carefully reviewed to match individual property needs. Regular policy assessments are vital for adapting to changing market and environmental risks. After damage occurs, owners must document losses, notify insurers promptly, cooperate with adjusters for fair claim resolution based on policy terms.

In the dynamic realm of real estate, securing adequate insurance coverage for damages is paramount. This comprehensive guide navigates the intricate landscape of property protection, offering insights into understanding and maximizing your insurance benefits. We explore key factors in achieving comprehensive coverage, demystifying the claims process, and empowering property owners to safeguard their investments effectively. By delving into these essential aspects, you’ll gain a strategic edge in mitigating risks and ensuring financial security for your real estate assets.

Understanding Insurance Coverage for Real Estate Damages

Understanding insurance coverage for real estate damages is crucial for property owners and investors alike. In the event of unforeseen circumstances, such as natural disasters or structural failures, having adequate protection can significantly mitigate financial losses. Insurance policies designed for real estate specifically cater to these risks, covering everything from physical damage to liability claims arising from property defects.

These policies typically include provisions for repairs or rebuilding costs, replacement of personal property, and legal fees associated with disputes. When selecting a policy, it’s essential to review the coverage limits, deductibles, and specific exclusions to ensure they align with your real estate investment’s needs. By doing so, you’ll be better equipped to navigate potential damages and protect your financial interests in the dynamic landscape of real estate.

Key Factors in Securing Comprehensive Protection

When securing insurance coverage for damages in real estate, several key factors play a pivotal role in ensuring comprehensive protection. Firstly, understanding the specific risks associated with your property is essential. This includes natural disasters like floods or earthquakes, as well as potential hazards unique to the location, such as high crime rates or vulnerability to fire. Insurance providers often tailor policies based on these considerations, offering various coverage options that align with local risks.

Additionally, the value of your real estate and its contents is a crucial determinant. Assessing the replacement cost of the property and its fixtures can help you determine adequate insurance limits. High-value assets or those requiring specialized care may necessitate higher coverage amounts to safeguard against potential losses. Regular reviews and adjustments to your policy are also vital, considering market fluctuations and changes in the surrounding environment.

Navigating Claims Process: What Property Owners Need to Know

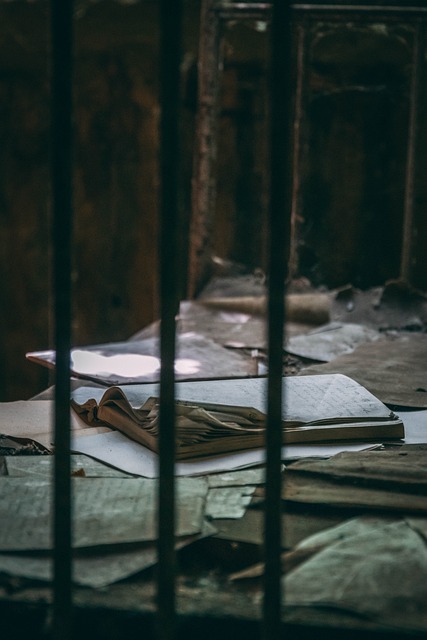

Navigating the claims process is a crucial step for real estate property owners seeking insurance coverage for damages. It involves understanding the steps to take after sustaining damage to their investment, whether from natural disasters, accidents, or other unforeseen events. The first step is to assess the extent of the damage and document it with photos and detailed records. This comprehensive documentation will be vital when filing a claim with the insurance provider.

Next, property owners should contact their insurance agent or company to inform them about the incident and begin the claims process. They’ll need to provide information about the damage, including the date, time, and cause. The insurer will then assign an adjuster to assess the loss and determine coverage based on the policy terms. Property owners must cooperate fully with the adjuster, providing all necessary details and evidence to support their claim for a swift and fair resolution.